Things are returning to normal in many places throughout the US as more and more folks get vaccinated.

Plus, travel season and warm weather are here — and people are itching to get out and let go of that pandemic stress.

As for the economy, official data indicates that things are back on track and we’re ready to kill it again.

But is that true? Or is there more to the story?

Well, let’s discuss the official numbers.

The official data makes it look like the economy has fully or almost fully recovered from the pandemic and lockdowns of the past year. In particular, the US gross domestic product (GDP) is at an all-time high. Usually, that’s a strong indicator of economic strength.

However, I don’t like to take things at face value. Data and statistics can push people to different conclusions depending on how it’s presented, especially when it’s an official number like GDP.

So let’s probe a little deeper.

When we do so, we find out that there’s a chance our economic recovery isn’t sustainable.

Transfer Payments and Economic Contraction

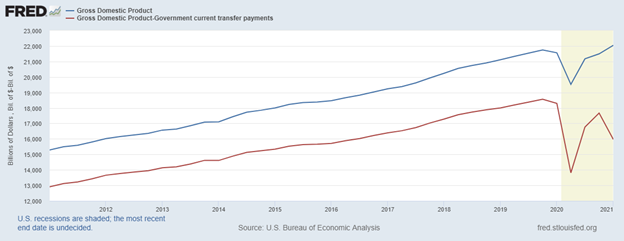

The above chart, pulled from the Federal Reserve Economic Data (FRED), shows GDP in two separate ways.

The blue line is GDP as the official data reports. No edits or anything.

However, the red line is our GDP when you subtract government transfer payments from the equation.

Transfer payments are defined as “payments for which no current services are performed and are a component of personal income.” The “transfer” part comes from the fact that money is simply moved from one place to another without providing any economic value to obtain that money.

So basically, government programs like Social Security, welfare programs, and of course, stimulus checks and unemployment.

The economy always has some transfer payments moving through it. In normal times, people collect unemployment if they can’t find work, retirees are paid Social Security, those at certain levels of income may receive benefits from other welfare programs, and so on.

But starting in early 2020, right when the country (and the world) began locking down their economies, several rounds of stimulus and expanded unemployment benefits drastically increased the dollar amount of transfer payments moving through the economy.

So back to that chart:

The trend lines look much the same, with a slightly larger drop in the red line right when COVID hit.

However, check out what happens in that last quarter of 2020. The blue line (official GDP data) shows a GDP increase over the last quarter…

But the red line (GDP without transfer payments) shows a sharp decline in GDP.

What does this mean?

Well, the data indicates the economy actually contracted in the most recent quarter, despite the more recent round of stimulus sent out to consumers. In other words, the economy may have recovered solely due to transfer payments.

And an economy built on moving money between places or people without value creation cannot stand. That’s not how economies work.

Therefore, we may have seen an even worse economy at the height of the pandemic, but our economy might have been better off as we emerged.

The Velocity of Money and Money Supply Make Things Worse

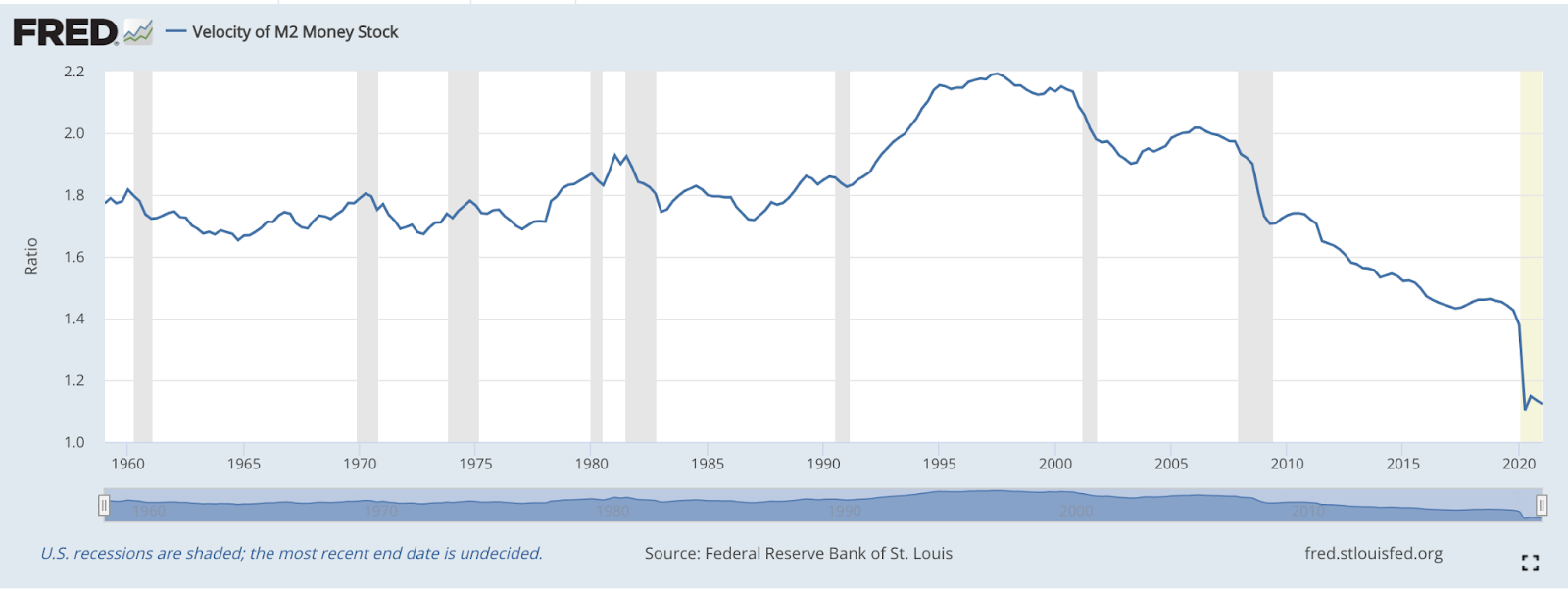

Money velocity tells you how fast dollars move through the economy by measuring how many times a dollar is used to buy goods and services over a defined timeframe.

Normally, every dollar spent within an economy increases the GDP by more than a dollar. Once again, this is because value is created — you hand someone money, they provide you a product or service that offers you value of some sort.

Thus, a higher velocity of money increases the GDP and vice-versa.

Now take a look at this chart from FRED:

The velocity of money decreased in the last quarter — the same quarter we’ve been talking about. That’s likely because various state governments are ending all these extra pandemic benefits, which means less government support money flowing through the economy.

So when you consider the money velocity decrease, the economic contraction might actually be worse than that red line in the first graph looks.

Looking ahead, the economy is going to have to stand on its own eventually. And it will be forced to soon, as expanded benefits and stimulus payments are likely ending. The economy will do well if private sector growth can offset the lost spending caused by the withdrawal of government aid.

Fortunately, you can stay ahead of economic conditions — whatever they may be — if you cultivate additional sources of income.

One income source that’s especially sensitive to economic changes is trading. You can profit off nearly any economic change if you know what you’re doing.

If that’s something you’re interested in, I can help you inside my Big Energy Profits research service.