The thought process I’ll share with you transpired in my trading room on Thursday morning.

It’s a refreshing reminder to stick to your trading plan as often as possible.

(And that emotional discipline remains a crucial aspect of trading success).

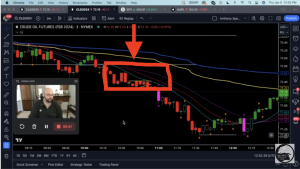

Just look at the setup in this chart.

The market is set up just how I like it.

Resistance? Flawless.

Fast-moving average? Beautiful.

Consolidation or correction? Check.

It doesn’t get better than this for me.

And on any other day, I would’ve sold my soul for this setup.

Except I had a rule I wasn’t willing to break, and it turned out I was right.

Here’s the short story short:

Sweet Crude Oil — the market in the chart above — usually has its inventory report at 10:30 am EST, but when we have a holiday week (in this case, New Year on Monday), the report release gets pushed to 11:00 am EST on Thursday.

That’s precisely when I found this trade.

But I didn’t take it because I avoid the markets upon news releases.

From my experience, anything that’s an economic news release always has the potential to cause uncertainty or extreme volatility in a short period.

This is precisely what happened with that irresistible setup I showed you earlier.

Even though the inventory report for Sweet Crude Oil was bullish, the S&P 500 extended its losing streak, and I would’ve lost a lot of money if I had gone all in.

The bottomline is that when you see seemingly irresistible setups like the one we’ve just discussed….

The allure of spontaneous decisions can be very tempting.

However, it always helps to remember that the most successful traders you admire have a lifelong habit of adhering to a meticulously crafted trade plan.

That emotional discipline is the bedrock of long-term trading success. And if you lack control, consider working with someone who can help you build discipline.

For more insight, see the emotional side of our big winners.

Wishing you many blessings,