A historic hydrogen project is on the horizon.

And it could have a significant impact on the transition to clean energy.

Here’s the story:

You know Mitsubishi Motors, right?

The Japanese automaker is poised to invest $690 million (over 100 billion Japanese Yen) in what could be the world’s largest green hydrogen project.

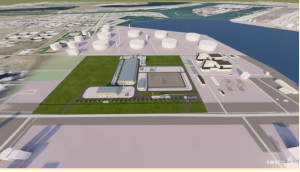

It’s called the Eneco Electrolyzer project — a joint venture Mitsubishi is working on with the Rotterdam-based energy firm Eneco. With 800 megawatts (MW) capacity and an annual hydrogen production target of 80,000 tons, the project could pave the way for cleaner, cheaper, more sustainable energy in the future.

Fueled by renewable energy from solar parks and wind farms, “green hydrogen” from the Eneco plant will find its initial applications in the industrial sector before being rolled out to retail consumers (depending on the project’s success).

Construction will start in 2026, and operations could begin in 2019.

Now, unlike coal and oil, green hydrogen leaves no residue in the air.

It only emits water vapor.

And it’s been used to fuel cars, airships, and spaceships since the 19th century.

In other words, it has a strong case as a clean energy source.

So why isn’t it mainstream yet?

Well, it costs around $1.8 to $14 to produce a kilogram of green hydrogen.

In comparison, the cost to refine gasoline varies between $0.40 and $0.70 per gallon — depending on whether summer or winter formulas are used.

That’s where the Eneco Electrolyzer project could be a game-changer.

It will be developed next to the Enecogen power station in Europoort.

This enables the two facilities to share some infrastructure…

Which has cost and realization time advantages.

If Mitsubishi and Eneco could figure out a way to produce a kilogram of green hydrogen for even less than 50% of what it costs today, they would have created a blueprint that can be replicated across 196 countries per the Paris Agreement.

Since the plant is expected to start operations in 2029, it’s still too early to say with certainty what kind of investment opportunities will arise from this trend.

If interested, please follow the Eneco story to see how it pans out.

But in the meantime, you can “strike while the iron is hot” — by targeting oil and gas instruments delivering incredible gains as the Middle East crisis continues.

For more insight, see my playbook for big oil profits in today’s market.

To big profits and beyond,